What’s Driving the Remarkable Rise of the Oral GLP-1 Market Today?

This report, published by Towards Healthcare, a sister firm of Precedence Research offers a comprehensive analysis of the rapidly expanding Oral GLP-1 market. It highlights the market’s accelerating growth trajectory, driven by rising therapeutic demand, strong innovation pipelines, and evolving industry investments.

Ottawa, Dec. 05, 2025 (GLOBE NEWSWIRE) -- The oral GLP-1 market is rapidly advancing on a scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2035. Market forecasts suggest robust development propelled by accelerated investments, innovation, and increasing demand across different industries.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6351

Key Takeaways

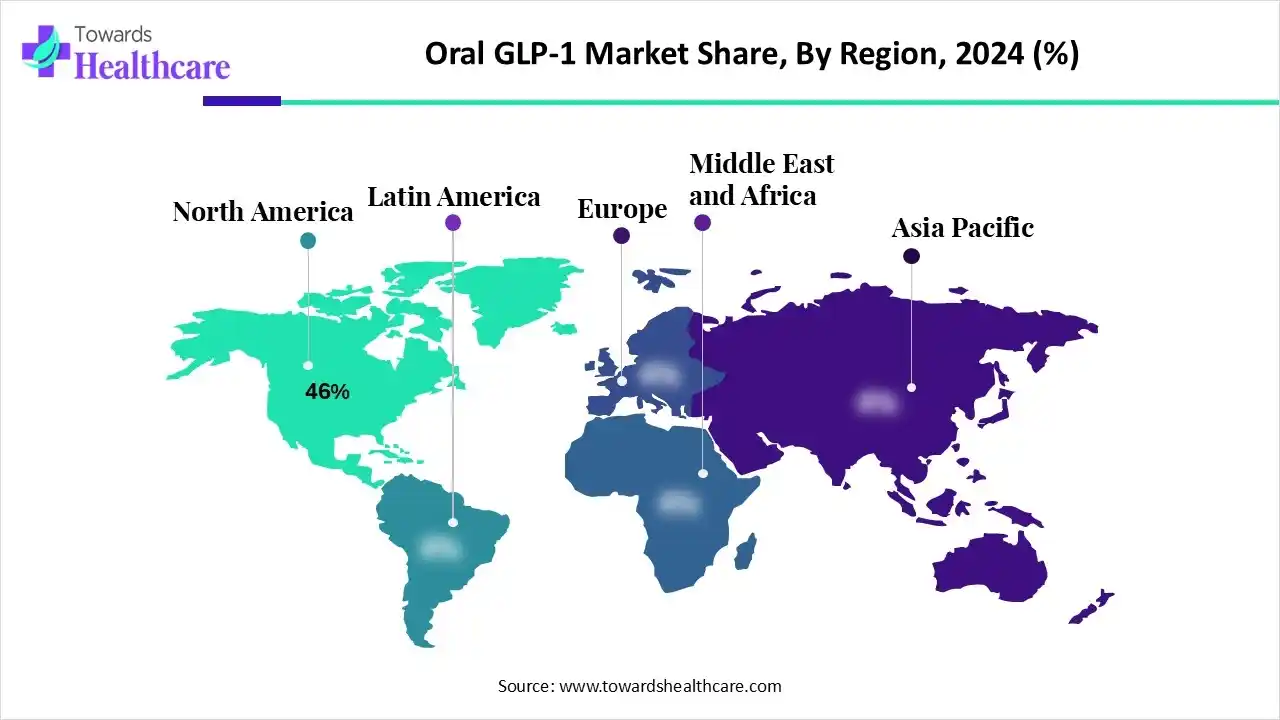

- North America was dominant in the market by 46% in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By drug type, the oral peptide GLP-1 agonists segment led the market in 2024.

- By drug type, the small-molecule non-peptide GLP-1 agonists segment is expected to grow rapidly during the forecast period.

- By molecule, the semaglutide segment dominated the oral GLP-1 market in 2024.

- By molecule, the orforglipron segment is expected to register the fastest expansion in the studied years.

- By distribution channel, the hospital & specialty clinics segment captured a major revenue share of the market in 2024.

- By distribution channel, the online pharmacies segment is expected to grow rapidly in the upcoming years.

- By end user, the diabetic population segment accounted for the largest share of the market in 2024.

- By end user, the obese/overweight individuals segment is expected to witness rapid growth during 2025-2034.

Exploration of Promising Studies: What are the Impactful Efforts in the Consistent Development of Oral GLP-1?

They usually encompass drugs that mimic the natural GLP-1 hormone in pill form, serving as a substitute to injections for managing type 2 diabetes and obesity. The global oral GLP-1 market has major growth factors, including rising cases of type 2 diabetes and obesity, the expanding patient preference for oral administration over injections, and the transformation of more efficacious oral drug formulations. Ongoing innovations mainly involve newer clinical studies on 25 mg and 50 mg once-daily oral semaglutide doses result in crucially increased weight loss and better glycemic control as compared to the initial 14 mg dose. Alongside, the leaders are promoting small-molecule non-peptide drugs, such as Orforglipron (Eli Lilly), in Phase 3 clinical trials for the treatment of both type 2 diabetes and obesity.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drivers in the Oral GLP-1 Market?

Current research activities are leveraging an expansion of GLP-1 receptor agonists for new purposes, like cardiovascular disease, non-alcoholic steatohepatitis (NASH), kidney disease, and other related concerns. However, the global market is further fueled by the future patent expirations for some GLP-1 drugs will support their generic versions, with escalated competition and potentially making the drugs cost-effective.

What are the Prominent Trends in the Oral GLP-1 Market?

- In November 2025, Lilly invested €2.6 billion for oral GLP-1 manufacturing capability with a new Netherlands facility.

- In August 2025, Eli Lilly and Company presented positive topline results from the Phase 3 ATTAIN-1 trial, evaluating orforglipron, an investigational oral glucagon-like peptide-1 (GLP-1) receptor agonist, in 3,127 adults with obesity, or overweight with a weight-related medical problem and without diabetes.

What is the Major Limitation in the Oral GLP-1 Market?

Specific challenges around the global market are the need for greater manufacturing expenditures and complex synthesis, as well as probable side effects, such as gastrointestinal issues, and the requirement for regulatory oversight to manage safety and access.

Regional Analysis

Why did North America Dominate the Market in 2024?

By capturing a major revenue share, North America led the market in 2024. As per the NIH survey, there were nearly 33.6 to 35.4 million cases of type 2 diabetes in 2024 in the US, and it is anticipated to grow to 54.9 million cases by 2030. The possession of more sophisticated healthcare systems, rising progression of oral formulations and robust reimbursement policies are assisting the comprehensive regional expansion.

For instance,

- In November 2025, Novo Nordisk released four new analyses on oral semaglutide 25 mg (Wegovy in a pill) at ObesityWeek 2025, which also explored reductions in cardiovascular risk factors.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What Made the Asia Pacific Grow Notably in the Oral GLP-1 Market in 2024?

In the upcoming era, the Asia Pacific is predicted to expand rapidly in the market, with prominent factors, like an enhancement in urbanization and a changing lifestyle. Whereas India, China, and Indonesia are encouraging universal health coverage and increasing access to diabetes and obesity treatments. In 2025, Innovent received approval for mazdutide, which is China's first dual GCG/GLP-1 receptor agonist, for chronic weight management, and continuing Phase 3 trials for MASH and HFpEF.

According to the International Diabetes Federation (IDF), diabetes cases (mainly type 2 diabetes) in 2024 and by 2030

| Region/Country | In 2024 (Approx.) | By 2030 (Approx.) |

| Western Pacific Region | 206 million adults | 196.5 million |

| South-East Asia | 107 million adults | 115.1 million |

| China | 148 million adults | 140.5 million |

| India | 89.8 million adults | 101.0 million |

Segmental Insights

By drug type analysis

Which Drug Type Led the Oral GLP-1 Market in 2024?

The oral peptide GLP-1 agonists segment held the biggest share of the market in 2024. As these drugs have beneficial actions in weight loss, reduce risks of hypoglycemia, and cardiovascular protection, they further propel their adoption for both diabetes and obesity management. For this drug type, researchers are promoting innovations by using nanomicelles and recombinant bacteria to enhance oral bioavailability and therapeutic results.

Whereas, the small-molecule non-peptide GLP-1 agonists segment is estimated to register rapid expansion. Inclusion of raised stability, for greater oral delivery, omitting the requirement for injections and expanding patient adherence are impacting the market progression. Emerging small-molecule GLP-1 receptor agonists, including YN1548, are in development and demonstrate robust results in preclinical and early clinical studies.

By molecule analysis

How did the Semaglutide Segment Lead the Market in 2024?

In 2024, the semaglutide segment captured a dominant share of the oral GLP-1 market. The prominent cardiovascular and kidney protective effects are resulting in escalated FDA approval, and new data on increased doses and real-world efficiency are supporting the segmental growth. In this era, the FLOW trial released that weekly semaglutide lowers the risk of critical kidney events by 24% and substantial adverse cardiovascular events (MACE) by 18% in patients with type 2 diabetes and chronic kidney disease.

Furthermore, the orforglipron segment will expand rapidly during 2025-2034. Specifically, ongoing developments of Orforglipron explore major endpoints in the ACHIEVE-1 Phase 3 trial for type 2 diabetes, with a promising HbA1c reduction of 1.3−1.6% and average weight loss of 7.9% at the highest dose. It also has a crucial function in lowering blood pressure, LDL cholesterol, triglycerides, and inflammatory biomarkers, particularly high-sensitivity C-reactive protein (hsCRP).

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By distribution channel analysis

Which Distribution Channel Dominated the Oral GLP-1 Market in 2024?

The hospital & specialty clinics segment registered dominance with a major share of the market in 2024. Mainly, numerous clinics are fostering the adoption of a "wrap-around" care model, similar to that employed for bariatric surgery, with significant assistance from nutritionists, exercise physiologists, and behavioral health providers. Many hospitals are promoting integration of these therapies into their weight management and diabetes care programs, and certain are involved in the development of support systems.

The online pharmacies segment is anticipated to witness the fastest growth in the coming era. Advancing therapies are marketed and sold through online telehealth programs, coupled with virtual consultations and home delivery. A few specific online programs are executing alternative plans for weight management, especially lifestyle management programs, which enable patients to eventually taper off or come off medication completely. The recent advances include Noom is a compounded alternative through its online platform, combined with a psychology-based weight loss program.

By end user analysis

Why did the Diabetic Population Segment Dominate the Market in 2024?

The diabetic population segment held the biggest share of the oral GLP-1 market in 2024. These developing drugs are bolstering improvements in blood sugar control, encouraging weight loss, and providing substantial cardiovascular and kidney protection. Immersive clinical evidence for GLP-1s in assisting in the management of both type 2 diabetes and obesity, with raised physician and patient awareness of these advantages, is supporting the diabetic population.

However, the obese/overweight individuals segment is predicted to register the fastest growth. Due to the sedentary lifestyle, the diverse regions, especially the Asia Pacific countries, are facing a huge burden of obese individuals. Recently, in 2025, the WHO issued its first global guideline on the use of GLP-1 medicines for treating obesity, which showed obesity as a chronic disease with a need for long-term pharmacological treatment. Also, it has suggested these therapies for adults with obesity (BMI ≥ 30) as an adjunct to a healthy diet and physical activity.

Browse More Insights of Towards Healthcare:

The molecule therapeutics market is growing due to the field of molecular therapeutics is significant in medicine and human biology, as it provides novel information on the discovery, diagnosis, and treatment of present and emerging diseases.

The global hematuria treatment market size is calculated at USD 1.13 billion in 2025, grew to USD 1.17 billion in 2026, and is projected to reach around USD 1.55 billion by 2035. The market is expanding at a CAGR of 3.15% between 2026 and 2035.

The global cell therapy market size was estimated at US$ 7.21 billion in 2025 and is projected to grow to US$ 55.72 billion by 2035, rising at a compound annual growth rate (CAGR) of 22.69% from 2026 to 2035.

The global 3D printed drugs market size is calculated at US$ 131.25 million in 2025, grew to US$ 151.4 million in 2026, and is projected to reach around US$ 547.36 million by 2035. The market is expanding at a CAGR of 15.35% between 2026 and 2035.

The global sinusitis drugs market size is calculated at USD 2.33 billion in 2025, grew to USD 2.47 billion in 2026, and is projected to reach around USD 4.16 billion by 2035. The market is expanding at a CAGR of 5.96% between 2026 and 2035.

The human growth hormone injection market size touched US$ 4.53 billion in 2025, with expectations of climbing to US$ 4.82 billion in 2026 and hitting US$ 8.54 billion by 2035, driven by a CAGR of 6.55% over the forecast period.

The global respiratory health supplements market size is calculated at US$ 8.78 in 2025, grew to US$ 9.46 billion in 2026, and is projected to reach around US$ 18.52 billion by 2035. The market is expanding at a CAGR of 7.75% between 2026 and 2035.

The global vaccine adjuvant market size recorded US$ 747.6 million in 2025, set to grow to US$ 795.67 million in 2026 and projected to hit nearly US$ 1394.15 million by 2035, with a CAGR of 6.43% throughout the forecast timeline.

The global diabetic neuropathy treatment market size is calculated at USD 4.71 in 2024, grew to USD 5.07 billion in 2025, and is projected to reach around USD 9.93 billion by 2034. The market is expanding at a CAGR of 7.75% between 2025 and 2034.

The global precision medicine market size is calculated at USD 118.52 billion in 2025, grow to USD 137.9 billion in 2026, and is projected to reach around USD 538.83 billion by 2035.The market is expanding at a CAGR of 16.35% between 2026 and 2035.

What are the Recent Developments in the Oral GLP-1 Market?

- In December 2025, Eli Lilly and Company (Lilly) launched the first patient visit for the SURMOUNT-REAL UK five-year, randomized, real-world clinical trial.

- In November 2025, the Pan American Health Organization (PAHO) unveiled the online course Caring for People with Type 2 Diabetes Mellitus in Primary Health Care, a free, self-paced learning tool for elevating the skills and knowledge of primary health care teams.

- In November 2025, Thyrocare introduced GLP-1 Health Check packages to assist monitoring during GLP-1 therapy.

Oral GLP-1 Market Key Players List

- Novo Nordisk

- Eli Lilly

- AstraZeneca

- Roche

- Viking Therapeutics

- Merck

- Structure Therapeutics

- Verdiva Bio

- Sun Pharma

- Pfizer

- Zealand Pharma

- Rani Therapeutics

- Hengrui Medicine

- Altimmune

- Eccogene

Segments Covered in the Report

By Drug Type

- Oral Peptide GLP-1 Agonists

- Small-Molecule Non-Peptide GLP-1 Agonists

By Molecule

- Semaglutide (Oral Formulation)

- Danuglipron

- Orforglipron

- Lotiglipron

- Other Emerging Candidates (GLP-1/GIP dual or non-peptide analogs)

By Distribution Channel

- Hospital & Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By End User

- Diabetic Population

- Obese / Overweight Individuals

- Cardiovascular-Risk Patients

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6351

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.