EU Packaging Waste Outlook 2023-2034 Trends, Recycling Performance, and Sustainability Progress

The EU Packaging Waste Outlook 2023-2034 highlights Europe’s steady progress toward sustainability. In 2023, the EU generated 79.7 million tonnes of packaging waste with a 67.5% recycling rate, nearing the 2030 target of 70%. Plastic bag use dropped by 30 bags per person since 2018, reflecting strong eco-policy impact. The packaging waste management market is set to grow from USD 39.78 billion (2025) to USD 54.21 billion (2034), driven by circular economy goals and innovation.

Ottawa, Oct. 31, 2025 (GLOBE NEWSWIRE) -- The Europe packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The increased demand for advanced packaging solutions in various end-user industries like food & beverages and pharmaceutical companies is driving the European packaging market.

Europe is the hub for robust packaging manufacturers and strict government regulation, emphasizing the development of biodegradable, reusable, and recyclable packaging solutions in the region. EU regulations like the single-use plastic directive and the packaging and packaging waste directive are fueling the sustainability trends. The Europe packaging market is a demonstration of sustainability and eco-friendliness demands.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

In 2023, people living in the European Union generated 79.7 million tonnes of packaging waste that’s about 177.8 kilograms per person. While this was 8.7 kg less per person than in 2022, it’s still 21.2 kg more than in 2013.

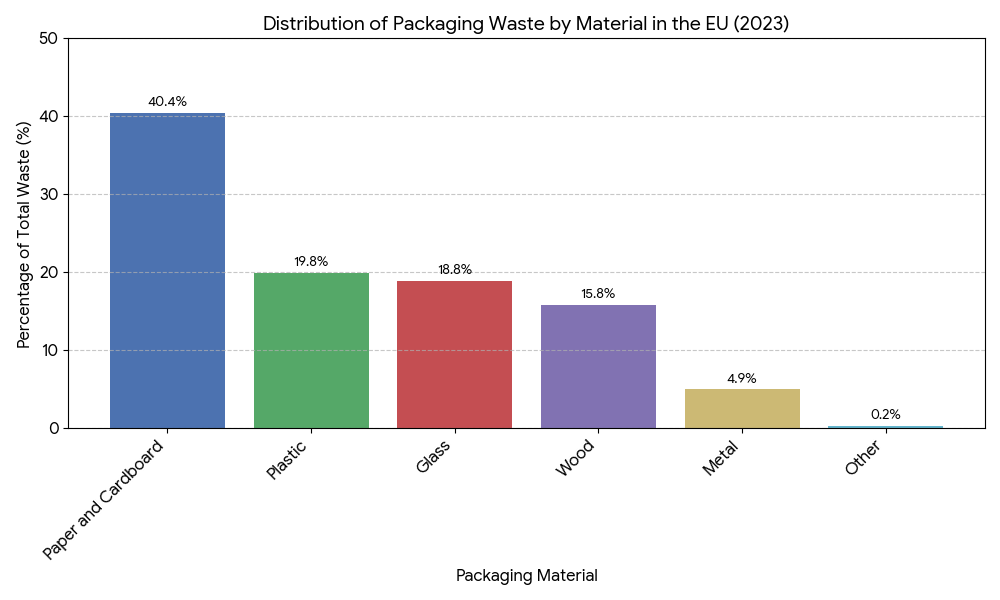

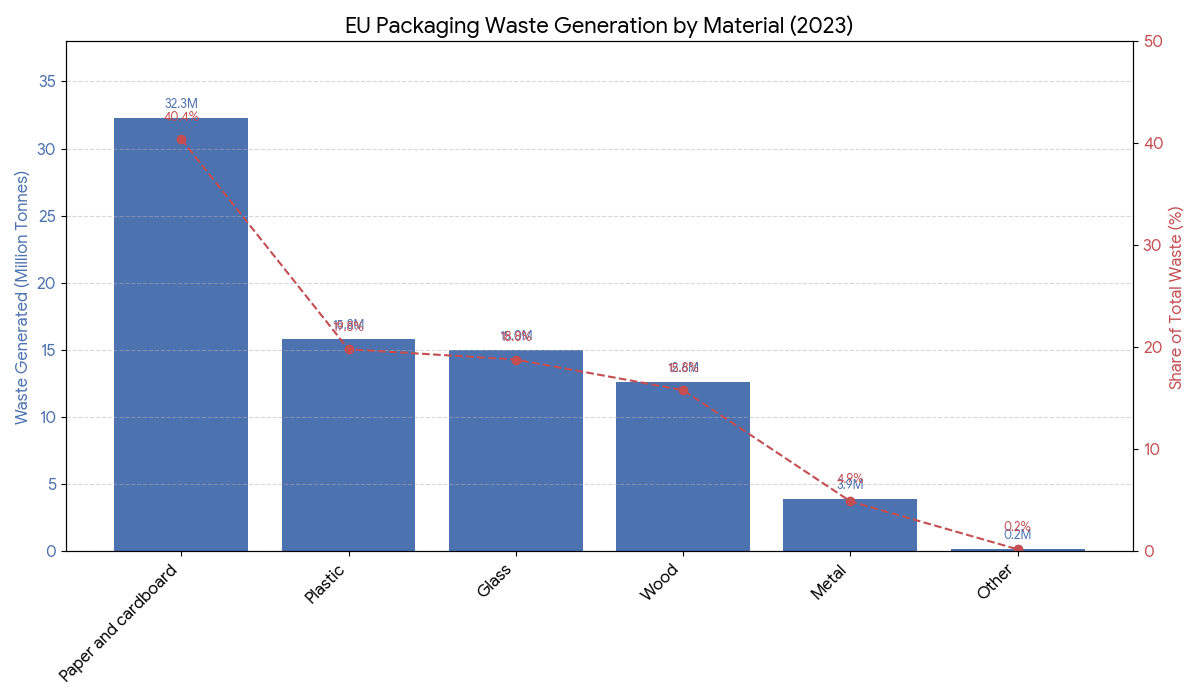

Of all packaging waste, paper and cardboard made up 40.4%, plastic was 19.8%, glass accounted for 18.8%, wood for 15.8%, metal for 4.9%, and the remaining 0.2% was other materials.

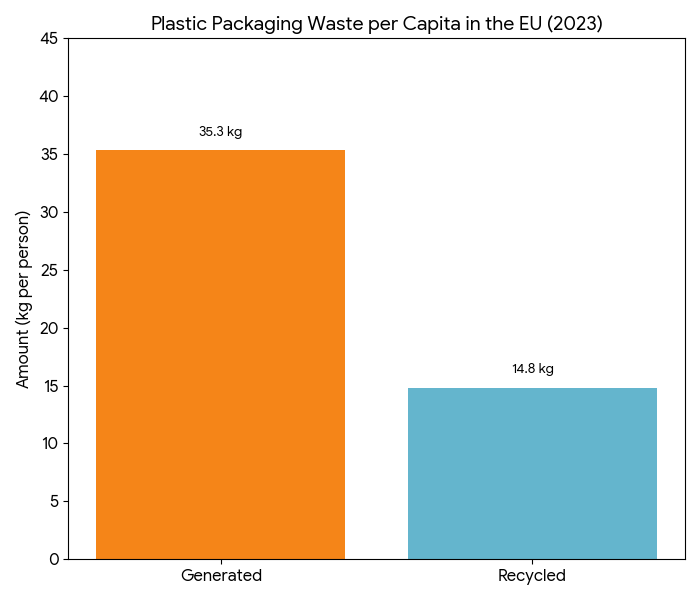

On average, each EU citizen produced 35.3 kg of plastic packaging waste, out of which 14.8 kg was recycled. Compared with 2022, this was 1 kg less plastic waste generated but 0.1 kg more recycled. Over the last decade (2013–2023), plastic packaging waste per person rose by 6.4 kg, and recycling improved by 3.8 kg per person.

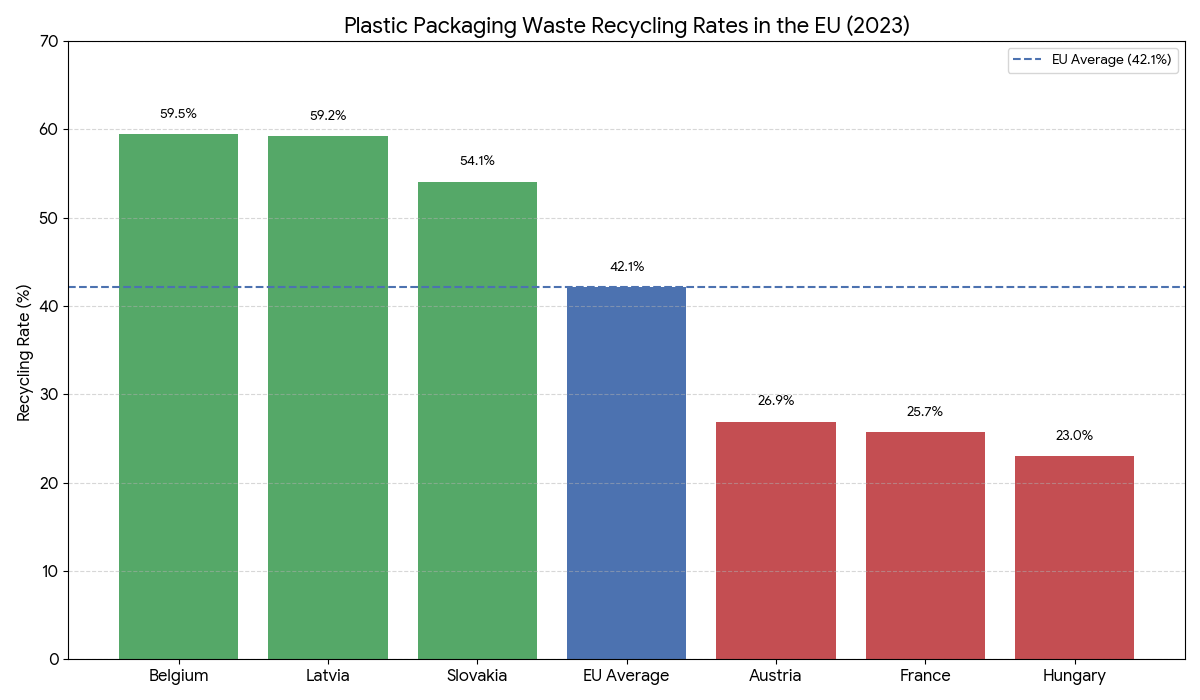

In 2023, the European Union showed progress in tackling its plastic packaging waste, successfully recycling 42.1% of all the plastic packaging generated. This is a positive step, as the recycling rate has increased significantly from the 38.2% recorded in 2013.

However, performance varies widely across member states:

- The countries leading the charge in plastic recycling are Belgium, with the highest rate at 59.5%, followed closely by Latvia (59.2%) and Slovakia (54.1%).

- On the other hand, several countries are lagging behind. The lowest recycling rates were recorded in Hungary (23.0%), France (25.7%), and Austria (26.9%).

Packaging Waste Trends

- In 2023, the EU generated a massive total of 79.7 million tonnes of packaging trash.

- That works out to 177.8 kilograms (kg) of waste for every person.

- This figure is positive because it marks a significant decrease—8.7 kg less per person—compared to 2022.

Plastic Bag Consumption Success

- The use of lightweight plastic carrier bags dropped substantially!

- On average, each person in the EU used 65 bags in 2023, which is 30 fewer bags per person than in 2018.

- Some countries achieved outstanding reductions: Sweden led the way by cutting its usage by 131 bags per person, followed by Lithuania (down 125 bags) and Latvia (down 118 bags).

Exceeding Recycling Targets

- A number of EU nations are already achieving high recycling success for all types of packaging waste.

- Seven countries Belgium, Netherlands, Italy, Czechia, Slovenia, Slovakia, and Spain—have already met or exceeded the EU's 2030 target of recycling more than 70% of their packaging waste.

- An additional six countries are close to this goal, boasting recycling rates above 65%.

EU Packaging Waste: A Comprehensive Overview (2023)

In 2023, the European Union generated a total of 79.7 million tonnes of packaging waste, equating to 177.8 kg for every person. While this marked a positive reduction of 8.7 kg per capita compared to 2022, the overall figure remains significantly higher than a decade ago.

The waste is primarily composed of Paper and Cardboard at 40.4% (32.3 million tonnes), followed by Plastic at 19.8% (15.8 million tonnes), Glass at 18.8%, and Wood at 15.8%. This general distribution holds true across most member states, although Bulgaria was the sole exception where plastic waste exceeded paper/cardboard.

Plastic Waste and Recycling Efforts

Plastic packaging waste remains a critical concern. In 2023, the average person generated 35.3 kg of plastic packaging waste, a figure that has increased by 6.4 kg since 2013.

Despite the rise in generation, the EU is improving its recycling performance:

- The EU recycled 42.1% of all generated plastic packaging waste in 2023, an increase from 38.2% in 2013.

- Belgium led the way with the highest recycling rate at 59.5%, followed by Latvia (59.2%) and Slovakia (54.1%).

- In contrast, Hungary recorded the lowest rate at 23.0%.

Furthermore, successful policy measures have sharply reduced the use of lightweight plastic carrier bags. Consumption fell by 30 bags per person compared to 2018, with the average person using 65 bags in 2023. Sweden, Lithuania, and Latvia achieved the largest per capita reductions.

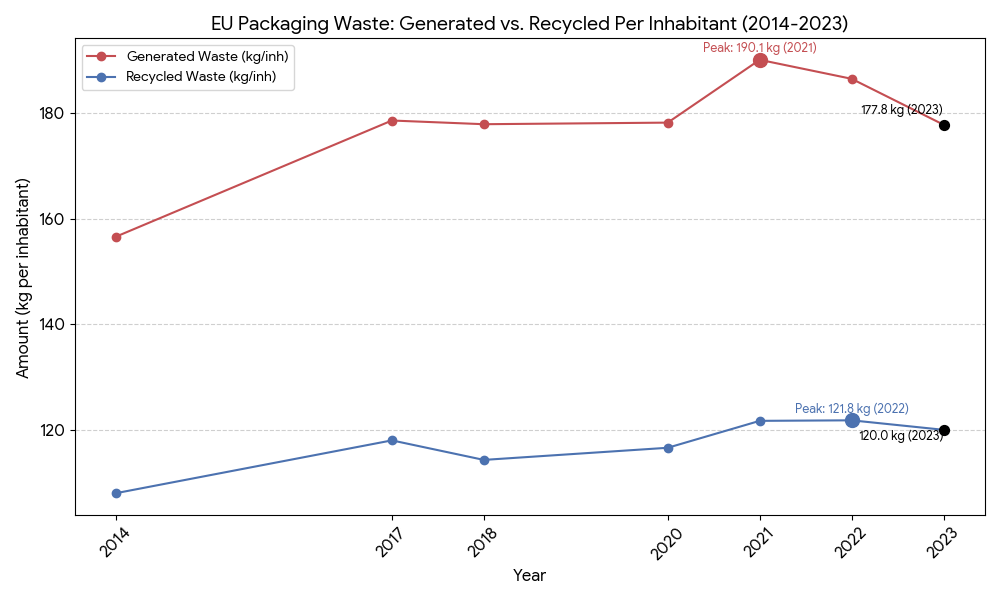

Evolution of Packaging Waste Generation and Recycling per Inhabitant in the EU (2014–2023)

Between 2014 and 2023, the European Union witnessed notable changes in packaging waste generation and recycling per inhabitant, encompassing all packaging materials such as paper and cardboard, plastic, glass, wood, metal, and others.

In 2023, the amount of packaging waste generated decreased by -4.7%, reaching 177.8 kg per inhabitant compared to the previous year. The peak level within this period was observed in 2021, at 190.1 kg per inhabitant, which was 6.7% higher than in 2020. From 2014 to 2021, the amount of packaging waste generated in the EU had consistently increased year-on-year, except for a minor decline of -0.4% in 2018.

Regarding recycling, from 2022 to 2023, the amount of packaging waste recycled fell moderately by -1.5%, resulting in 120.0 kg per inhabitant. The highest recycling levels were recorded in 2021 (121.7 kg per inhabitant) and 2022 (121.8 kg per inhabitant). Over the period 2014–2021, recycled packaging waste generally followed an upward trend, interrupted only by decreases in 2018 (-3.1%) and 2020 (-1.0%).

Overall, while packaging waste generation in the EU peaked in 2021 and declined thereafter, recycling volumes remained relatively stable with minor fluctuations, reflecting ongoing efforts toward sustainability and circular economy goals across member states.

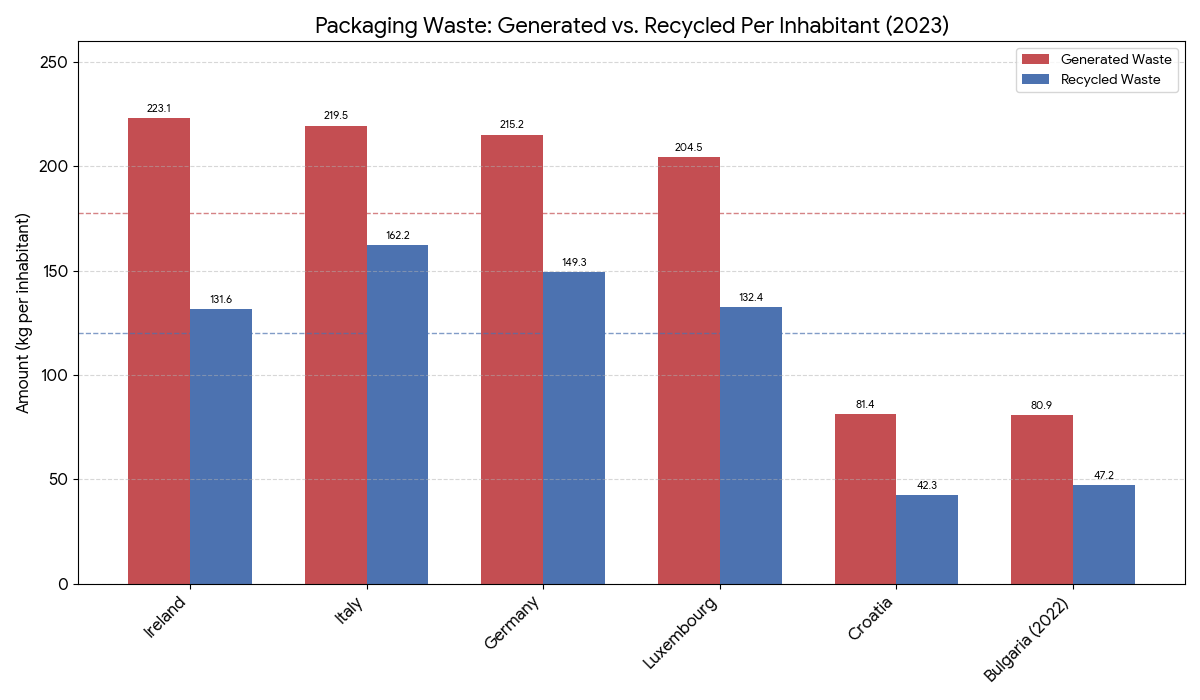

Packaging Waste Generation and Recycling Across EU Countries in 2023

In 2023, the EU and EFTA countries reported significant variations in packaging waste generation and recycling per inhabitant. The total waste generated per person ranged from 80.9 kg in Bulgaria (2022 data) to 223.1 kg in Ireland, marking Ireland as the country with the highest packaging waste generation.

Among the EU members, 15 countries recorded 150 kg or more of packaging waste generated per inhabitant. Notably, Ireland (223.1 kg), Italy (219.5 kg), Germany (215.2 kg), and Luxembourg (204.5 kg) all exceeded 200 kg per inhabitant. At the lower end, Bulgaria (80.9 kg), Cyprus (98.6 kg; 2022 data), and Croatia (81.4 kg) generated less than 100 kg of packaging waste per person.

Despite their high waste generation, Italy, Germany, and Luxembourg also demonstrated strong recycling performance. In 2023, Italy achieved the highest recycling rate, processing 162.2 kg per inhabitant, followed by Germany (149.3 kg), Luxembourg (132.4 kg), and Ireland (131.6 kg) — the latter notable for balancing high waste generation with substantial recycling.

Conversely, the lowest recycling levels were recorded in Croatia (42.3 kg), Bulgaria (47.2 kg), and Romania (48.5 kg) (2022 data), reflecting their overall lower packaging waste generation.

Looking ahead, the EU’s 2030 recycling targets set ambitious goals: at least 70% of all packaging waste should be recycled by weight. Specific material targets include 85% for paper and cardboard, 75% for glass, 55% for plastics, 80% for ferrous metals, 60% for aluminium, and 30% for wood. These percentages are calculated based on the weight of recycled packaging waste relative to the total waste generated, emphasizing the EU’s commitment to a more sustainable and circular packaging system.

Packaging Waste Management Market Growth, Innovations, and Market Size Forecast

The global packaging waste management market is expected to increase from USD 39.78 billion in 2025 to USD 54.21 billion by 2034, growing at a CAGR of 3.5% throughout the forecast period from 2025 to 2034. The global packaging waste management market is growing, driven by rising concerns about addressing rising pollution, rising consumer demand for sustainability, stringent governmental regulations, growing emphasis on circular economy principles, and increasing technological innovation in recycling technologies. Sustainability is increasingly becoming the key focus, encouraging the adoption of packaging waste management practices.

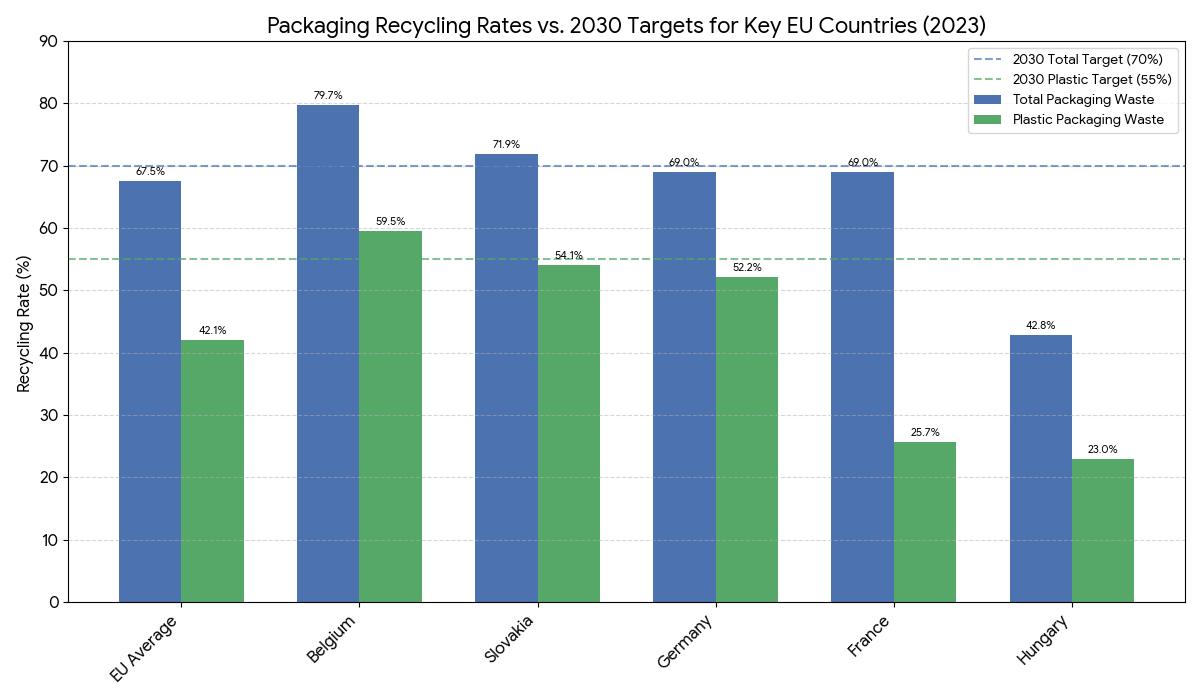

Recycling Rates of Packaging Waste in the EU and EFTA Countries (2023)

In 2023, the European Union (EU) achieved a total packaging waste recycling rate of 67.5%, bringing it close to the 2030 target of 70%. The figure representing the data highlights how various EU and EFTA countries are progressing toward this sustainability milestone.

Among the member states, seven EU countries had already met or exceeded the 2030 recycling target:

- Belgium (79.7%)

- Netherlands (75.8%)

- Italy (75.6%)

- Czechia (74.8%)

- Slovenia (73.6%)

- Slovakia (71.9%)

-

Spain (70.5%)

An additional 13 countries were approaching the 70% benchmark, maintaining recycling rates above 60%. Notably, Cyprus (2022 data), Germany, France, Estonia, and Sweden all reported recycling rates between 68.5% and 69.5%.

Conversely, four countries were at the lower end of the recycling spectrum, reporting rates below 50%:

- Romania (37.3%; 2022 data)

- Hungary (42.8%)

- Malta (44.4%)

- Greece (48.0%)

Regarding plastic packaging waste, the EU aims for a minimum recycling rate of 55% (by weight) by 2030. As of 2023, Belgium (59.5%) and Latvia (59.2%) were the only countries to have already achieved this target. Slovakia (54.1%), Czechia (52.4%), Germany (52.2%), and Slovenia (51.5%) were also closing in on the goal.

Meanwhile, four other countries reported plastic packaging recycling rates between 45% and 50%, indicating steady progress toward compliance. However, several EU members remained behind, with Hungary (23.0%), France (25.7%), Austria (26.9%), and Denmark (27.8%) recording the lowest plastic recycling rates. Additionally, Croatia, Sweden, Finland, and Ireland also reported plastic recycling rates below 30% in 2023, highlighting ongoing disparities in recycling efficiency across Europe.

Packaging Waste Recycling Market Size, Demand and Trends Analysis

The packaging waste recycling market is expected to increase from USD 34.50 billion in 2025 to USD 52.16 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The rising awareness towards ecological issues and strict guidelines such as Packaging and Packaging Waste Regulations. With rising ecological cons and strict guidelines, this industry is observing noteworthy development. As industries and government progressively arrange sustainable choices the market is growing significantly.

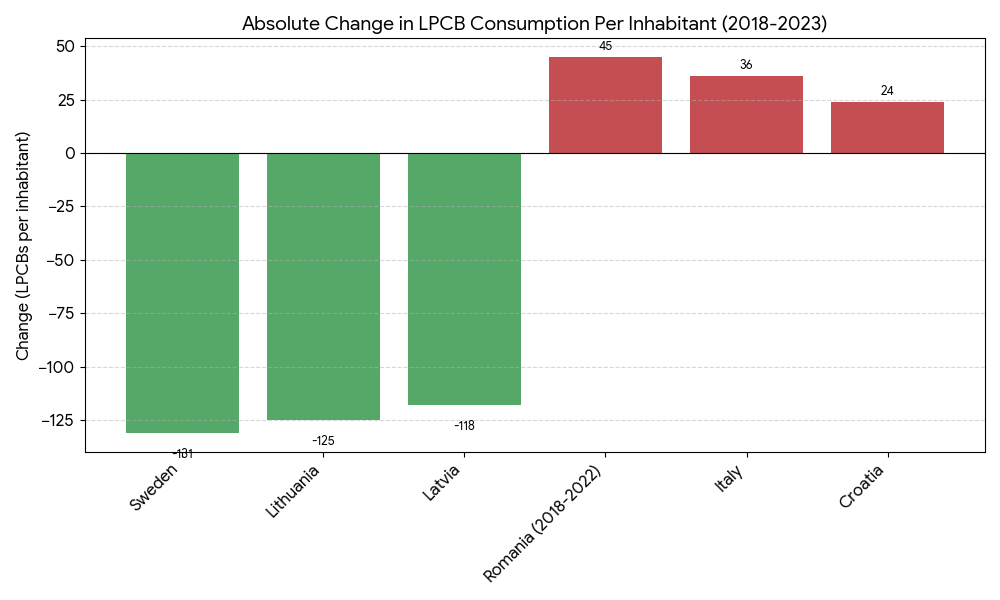

Consumption of Lightweight Plastic Carrier Bags (LPCBs) Across EU Countries in 2023

In 2023, the consumption of lightweight plastic carrier bags (LPCBs) varied widely across the European Union. The figures ranged from 4 LPCBs per inhabitant in Belgium to 209 LPCBs per inhabitant in Latvia, highlighting stark differences in consumption patterns and progress toward sustainability targets.

A total of nine EU countries had already reduced LPCB consumption below the target of fewer than 40 LPCBs per inhabitant, demonstrating strong compliance efforts. These included:

- Belgium (4 LPCBs)

- Poland (7 LPCBs)

- Portugal (14 LPCBs)

- Austria (14 LPCBs)

- Sweden (22 LPCBs)

- Denmark (23 LPCBs)

- Luxembourg (25 LPCBs)

- Netherlands (31 LPCBs)

-

Germany (31 LPCBs)

Additionally, Ireland (45 LPCBs) and France (46 LPCBs) were approaching the 2025 target, showing continuous progress in reducing single-use plastic consumption.

At the opposite end, Latvia reported the highest LPCB consumption, exceeding 200 bags per inhabitant (209 LPCBs). Lithuania (196 LPCBs) and Czechia (185 LPCBs) also recorded high levels, while seven other countries reported consumption between 111 and 131 LPCBs per inhabitant in 2023.

EU member states are required to report the total number of LPCBs consumed, with the option to voluntarily provide data on weight and on two specific categories:

- Very lightweight plastic carrier bags (VLPCBs) less than 15 microns thick.

- LPCBs with wall thickness between 15 and 50 microns.

Among 19 EU countries that submitted detailed 2023 data on these categories, the share of VLPCBs in total LPCB consumption varied significantly — from 97.1% in Ireland (indicating dominance of ultra-thin bags) to just 9.3% in Luxembourg. Other countries with high VLPCB shares included France (95.7%), Czechia (95.0%), Croatia (94.2%), and Hungary (92.2%).

Between 2018 and 2023, several EU nations achieved substantial reductions in LPCB consumption. The most notable decreases were observed in Sweden (-131 LPCBs per inhabitant), Lithuania (-125), Latvia (-118), Spain (-104), and Cyprus (-102). However, five countries reported increases during the same period — led by Romania (+45 LPCBs; 2018–2022), Italy (+36 LPCBs), and Croatia (+24 LPCBs).

In relative terms, the largest percentage reductions were achieved by Belgium (-86%), followed by Sweden (-85%), Luxembourg (-76%), Austria (-72%), and Poland (-70%), showcasing the EU’s growing commitment to reducing single-use plastics and promoting sustainable alternatives.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

More Insights in Recycle Packaging by Towards Packaging:

- Compostable and Recyclable Cups Market Strategic Growth, Innovation & Investment Trends

- Recyclable Shrink Film Market Research, Consumer Behavior, Demand and Forecast

- Recycled Aluminum Cans Market Forecast and Competitive Strategies

- Plastic Recycling Services Market Outlook Scenario Planning & Strategic Insights for 2034

-

Recyclable Packaging Market Size, Segmentation, and Competitive Landscape Analysis

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.